By RON HURTIBISE

Owners of Fort Lauderdale restaurant IT! Italy Ristorante Café & Bar filed suit Monday against global insurance giant Chubb Limited and its subsidiary Westchester Surplus

Lines over the insurer’s failure to pay a business COVID-19-related interruption claim.

The suit by the restaurant’s parent company, Cafe International Holding Company LLC, is an opening salvo in what insurance experts predict be a long, hard legal fight by businesses across the nation that might have to be resolved in the U.S. Supreme Court.

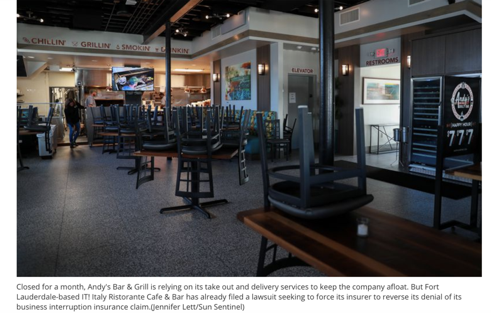

The company’s suit claims that the business interruption insurance it purchased requires Chubb to pay for loss of income caused by the action of a civil authority prohibiting access to the restaurant. In this case, the civil authority was Florida Gov. Ron DeSantis, who on March 20 signed an executive order requiring businesses to shut down their dining rooms, leaving only take-out, curbside or delivery service to provide cash flow.

The suit, filed by national law firms Podhurst Orseck and Boies Schiller Flaxner in U.S. District Court in Miami, seeks class action status so it can later add other Chubb-insured companies with unpaid business interruption claims that have been or will be denied, according to a statement released by the law firms Monday.

Chubb is the world’s largest property insurer with $40 billion in gross written premiums, $177 billion in assets and about 31,000 employees worldwide.

Cafe International is controlled by Hugo Bianchi and Jorge Frederico Llauro. Their restaurant IT! Italy Ristorante Café & Bar is on East Law Olas Boulevard. According to their attorneys, Cafe International owns five other restaurants.

Also included in the coverage that IT! purchased are “Extra Expense” coverage “under which [Chubb] promised to pay expenses incurred to minimize the suspension of business and “Civil Authority” coverage, payable for losses caused “by the action of a civil authority prohibiting access to the business, the lawsuit states.

About 60% to 70% of commercial policies offered by property and casualty companies contain language specifically excluding coverage for revenue lost because of a pandemic, said two attorneys in the case, Steven Zak and Steven Marks. But the policy that IT! Italy Ristorante Café & Bar includes no such exclusion.

Standard policies cover business interruption when properties are directly damaged by fire, flood or tornadoes.

That leaves about 30% to 40% of policies that do not have the exclusion, Zak said Monday.

On CNBC, Chubb Limited CEO Evan Greenberg said the company has no intention of paying business interruption claims stemming from COVID-19 if policies do not clearly state that its covered. Most catastrophes, like hurricanes or earthquakes, are limited by geography or time, Greenberg said on CNBC’s “Mad Money with Jim Cramer.” Pandemics have no geographic bounds or time limits, Greenberg said. “Insurance companies have finite balance sheets, and the loss potential from a pandemic is infinite,” he said.

The insurance industry has $800 billion in capital “to insure all the risks we insure plus the catastrophe events” that may occur within a year. “I understand they’re looking for a remedy,” Greenberg said. But paying all business interruption claims “would be a self-inflicted injury and create great uncertainty at a time where we have enough uncertainty and we’re trying to heal the economy.”

The lawsuit argues that Chubb must pay the business interruption claim because their client was insured by an “All Risk” policy that “provide unconditional coverage for all risks of loss, except those which are specifically omitted.” Because losses from pandemics are not specifically omitted and pandemics are not specifically omitted, Chubb must map the claim, Marks said.

“Chubb made a deliberate decision not to exclude it,” said Marks. “Therefore our clients paid more in premium.”

A Chubb spokesman declined Monday to comment on the lawsuit Monday, saying only that, “As a matter of policy Chubb does not comment on client claims or pending legal matters.”

Numerous restaurant companies across the nation have already filed their own lawsuits over denied business interruption claims, according to a trade publication, Restaurant Business Online. They include a group of well-known celebrity chefs who formed an organization, Business Interruption Group (BIG), that plans to launch a nationwide campaign to pressure insurers.

Whether their business interruption insurance covers losses stemming from emergency public health crises has been a focus of frequent questions to Florida’s property insurance agents, said Jeff Grady, president and CEO of the Florida Association of Insurance Agents. “It’s probably one of the most frequent calls that our agents get — Do I have it? And if I do, am I covered?”

In most cases, the answer is no, Grady said, unless the business specifically bought interruption coverage that includes pandemics. He knows of only a couple instances where businesses specifically bought pandemic coverage — the Wimbledon tennis tournament and a large resort hotel, he said.

Yet lawmakers have started talking about forcing insurers to pay business interruption claims, and it’s making the industry nervous. President Donald Trump on April 10 weighed in on the subject, accusing insurers of saying ‘We’re not going to give it,’ and added, “We can’t let that happen.”

And some local-level governments have including language in their emergency orders, urged by attorneys for businesses, proclaiming that the COVID-19 virus causes property damage. Broward County’s emergency order 20-03 includes this clause:

“Whereas this Emergency Order is necessary because of the propensity of the virus to spread person to person and also because the virus is physically causing property damage due to its proclivity to attach to surfaces for prolonged period of time…”

A requirement that insurers pay all business interruption claims could easily bankrupt the insurance industry, Grady said. “It would be a bigger problem to bankrupt the risk transfer industry by making them pay for something that’s not covered, that [clients] didn’t pay premiums on,” Grady said.

Nevertheless, more suits are likely coming, Grady predicted. “It’s going to be litigated. I don’t think the Chubb case is going to be anything but the beginning of a very long slog that could end up before the Supreme Court,” he said.