Last week, a motion to dismiss a class-action lawsuit filed in the United States against four major Norwegian salmon farming firms was denied, allowing the suit to proceed. The lawsuit, filed in Miami, Florida, U.S.A. in 2019, makes the claim that major players in Norway’s farmed salmon industry exchanged competitively sensitive information among themselves, with the aim of artificially controlling the price of farm-raised salmon sold in the United States.

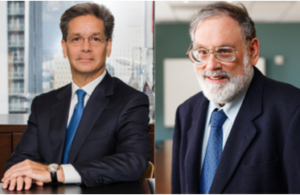

Lawyers from the two law firms representing the direct purchaser class in the suit spoke to SeafoodSource on Monday, 29 March, to explain their next steps and answer questions about the case. Peter Prieto, a partner with Miami-based Podhurst Orseck, said the decision was “a solid victory because antitrust cases oen get dismissed at this stage.” Michael Lehmann, a partner with San Francisco, California, U.S.A.-based Hausfeld LLP , previously said the case was in some part dependent on the outcome of ongoing European Commission and U.S. Department of Justice investigations, but told SeafoodSource that as the case has proceeded, it can now stand on its own merits.

Prieto: I don’t think our case is dependent on those investigations; They’re pursuing their own evidence. We have been given the opportunity to obtain records as well as sworn testimony from the defendants. Usually those types of criminal investigations run parallel to civil cases, but one really doesn’t have to do with the other, really. Also one distinction, in criminal cases, at least in the U.S., have to prove beyond reasonable doubt, whereas in civil cases, we just have to prove a preponderance of evidence, so that’s a significant factor of difference here.

Lehmann: If you look at the second consolidated complaint, we state that the NASDAQ Salmon Index was heavily manipulated and that caused prices to rise as a result. That manipulation was carried out partially as a result of intracompany sales of salmon to [Mowi subsidiary] Morpol. Not all of that is spelled out in either the U.S. Department of Justice or European Commission’s investigations.

SeafoodSource: The second amended complaint includes a significant shift in its focus on alleged manipulation of the NASDAQ Salmon Index, which was not mentioned in the original complaint. Why did you choose to home in on that in your amended complaint?

Lehmann: Keep in mind the identity of the committee-members that set the NASDAQ Salmon Index is a closely guarded secret that’s not made public or disseminated by NASDAQ. We only found out about the membership in the index as a result of documents produced to the U.S. Department of Justice and European Commission. That and other information contained in those court-ordered documents allowed us to bring that into our discussions. We always had a suspicion the NASDAQ Salmon Index played a role, but without the ability to identify its participants, we didn’t have the facts to support those allegations.

Prieto: In short, we just followed the evidence.

SeafoodSource: Are you concerned at all that the case might be frozen if and when E.U. or U.S. authorities decide to bring criminal charges?

Prieto: I think we have no indication that this case will be stayed pending a criminal investigation or case, though I don’t think we’re in a position to speculate if there will be a criminal case – that’s not up to us, it’s up to the Department of Justice.

SeafoodSource: Do you have any estimate of the purported damages caused by the price-fixing your clients allege?

Lehmann: The answer to that is, at present, we do not have any estimate of damages. We know there have been substantial volumes of farmed salmon sold into the U.S. over the last several years, including up to the beginning of the damage class period. What we lack is a transactional database that would allow us to compute the various sales and how they changed over time. We will be developing a damage analysis as we get transactional data from wholesale sales in the U.S.

SeafoodSource: Now that the case has formally been allowed to proceed, what are your next steps?

Prieto: We’re pleased with the court order, because now we’re permitted to proceed to discovery on the very strong allegations that we’ve made in the complaint. So we’ll be able to obtain documents and sworn testimony from some of the key witnesses in the case.

SeafoodSource: Who will be some of the individuals and experts from whom you hope to obtain testimony?

Prieto: It’s a bit too early to identify those witnesses, but we’re going to be doing that shortly.

Lehmann: We provided a list in the second consolidated complaint, and it’s entirely possible we’ll be seeking discovery from at least some of those individuals.

SeafoodSource: Do you think the schedule the judge has constructed – which calls for a trial to begin in May 2023 and attempted mediation to take place in June 2021 – is realistic?

Prieto: We have a very efficient judge on this particular case, and believe the schedule she has set is reasonable and we’ll doing everything we can to try to meet it.

SeafoodSource: How is this case similar or different to the canned tuna price-fixing class-action lawsuit, resolved last year?

Lehmann: My firm was also involved in that case, and from my perspective, I think the two cases are somewhat different. The tuna case involved multilateral phone calls and meetings during which discussions took place about setting the price of tuna. Various companies discussed it among themselves and used the telephone to communicate with each other. Some of that is alleged to have gone on here as well, but one thing that separates the salmon case from the tuna case is that here, worldwide prices were set utilizing the NASDAQ Salmon Index. We allege these companies engaged in a successful strategy for manipulating those prices upward by adding panelists to the committee, which then set that price on the index, essentially pushing them upward and thereby setting a floor on wholesales prices across the world, including in the U.S. There is no similar index in tuna, and that conspiracy relied on all the major players working together directly to set their prices. Another difference is that the geographies of the companies are different, with the allegations in the second amended complaint showing some of the activity occurred in Europe, while in the tuna case, even though there were some allegations that involved behavior in Asia, most of the case centered around issues that took place in the U.S.

SeafoodSource: Does it complicate your case that the defendants are all based in Europe?

Prieto: Anytime evidence is located abroad, it does create challenges. We’re hoping to meet those challenges and hopefully get defense’s cooperation on those kind of evidentiary issues.

SeafoodSource: Are you or your clients open to a settlement agreement in this case?

Prieto: In every case, the court will order mediation, so the parties can address a potential resolution in the case. In this case, the court has ordered that we agree on a mediator or she will appoint a mediator. At this point, that’s all we can say.

Lehmann: A settlement that benefits and appropriately compensates our class and our clients is something that we would always consider.

Photo courtesy of Podhurst Orseck and Hausfeld LLP